With City Manager Dr. Rob Buchan and Chief Financial Officer Corinne Bomben, marking the proposed tax hike for 2023 to a rate of 15.7 per cent.

The sticker shock of that number for 2023 coming following a number of years of modest or no tax increases of the past.

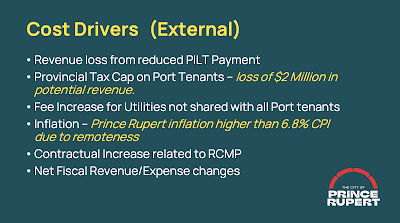

The narrative to the financial plan was similar to years past, with the issues of the Payment in lieu of Taxes and Port Tax Cap themes prominent to the reasoning behind the proposed spike to double digit taxation.

This years presentation noting of the significant drop in revenues from the Port properties and the city's ongoing work both politically and through legal options to try to gain further monies from the Prince Rupert Port Authority.

The delivery of the news, that of a three act play of sorts, Mr. Buchan with some foreboding prologue, Ms. Bomben with the listings of over ninety elements of proposed spending and other notes on the Port related issues, while Mayor Pond and Council had the third act to shape the Council message towards the call for a 15.7 percent increase.

"This has been an extraordinarily difficult Budget process and I would like to emphasize that this is a Draft Budget, it's not a proposed budget, it's a preliminary daft. We're at a point that council needs to consider the Draft and give direction. Further Budget Reductions may require service cuts and this needs to be directed by Council.

Staff have worked very hard to cut budget requests, however there are significant drivers, cost drivers that have impacted our ability to bring in a lower tax increase. We will review the internal and external cost drivers and also address the significant revenue challenges that are in part responsible for this potential tax increase" -- Doctor Robert Buchan opening Wednesday's 2023 Civic Budget.

The City Manager noted of the current state of infrastructure and the need for investment into it is required, observing of the past life expectancy and failing nature of some of the areas if that infrastructure.

Mr. Buchan framing those comments through the review of the financial and revenue challenges the city faces that have not allowed it to address them to look after its physical assets appropriately.

"Some of our principle revenue issues include the Port Tax Cap, the reduction of PILT payments by the Prince Rupert Port Authority. Both the Port Tax Cap and PILT payment reduction, place the burden of city operations and capital expenditures on residences and businesses and are not shard sufficiently by Port industries or the Port Authority.

Another challenge is our ferry service this requires an extraordinarily large subsidy every year to around one and half million dollars. So this really underscores the need for new revenues and reinstated revenues from the province and the Federal governments"

Dr. Buchan also noted of the ongoing work towards such initiatives as the Resource Benefit Agreement which is among several that the City is working on.

He also added some background to the hundreds of millions of dollars of infrastructure deficit noting how 26 kilometres of the water system is failing which will cost over 200 million dollars to renew just one quarter of the system.

Adding to the list is water treatment, sewage treatment and other infrastructure that needs investment. Much of which is reflected in the Utilities fees planning.

While 'pleased and thankful' for the recent 65 million dollars from the province, the City Manager noted of the need for additional civic monies towards infrastructure work.

"Even with these contributions there will be a need for funding by the city. And without fixes to our revenue problems the burden of that funding will be carried by residential and business properties. The PRPA and capped port industries will not share in this burden without changes that we are working on"

To set the stage for the listing of operational and capital funding requests to come from Ms. Bomben, the City Manager explained further the financial challenges the city is facing that are outside of its control.

"This year the city is experiencing a reduction in Budget Revenues from reduced Payment in Lieu of taxes of Port properties which accounts for 4.3 percent of the proposed increase.

This causes additional legal and appraisal fees that the city is dealing with this matter, the city has filed an application with the Dispute Advisory panel to argue against the reduction in the valuation that the Prince Rupert Port Authority imposed on us.

However a judgement on this dispute is not likely to be provided this year, so we cannot account for that in this budget season.

We would also like to note that because of the cap on Port Industrial properties the city is unable to share this increase among all property tax paying classes. If the city could charge all major industry operators the city's class four rate from last year, it would mean two million dollars of the budget paid by everyday people and business owners would be paid by the port terminals.

We have failing infrastructure pipes, but because the port operators aren't connected to the city's utilities, it means that they can't save in these fee increases that will ultimately occur to fix and replace the pipe network"

Mr. Buchan also observed as to the additional cost to the city owing to its remoteness, upcoming contractural increases related to the RCMP, and other financial expenses.

As well he noted to contract provisions, the request for additional staff and the funding requirements towards Community Enhancement Grants.

He also provided a review of the work related to the city's Local State of Emergency in December and the nature of the 24 hour a day work that was required to keep the water system functional.

Mr. Buchan wrapped up his presentation by taking the Council members and those watching from the Chamber or at home to the item of most note on the night that of the Draft tax increase.

"As I mentioned this has been an extraordinary, difficult budget year with internal and external cost drivers that have resulted in a tax rate increase of 15.7 percent.

To reduce this measurably in any significant way would probably mean service reductions and that as I mentioned is driven by Council.

And sadly this tax increase is not that far out of line with other communities and its somewhat higher with some of our unique situations in Prince Rupert" -- Doctor Robert Buchan's conclusion to his opening review on Wednesday's 2023 Civic Budget.

The full overview of the infrastructure challenges, financial themes and items unique to Prince Rupert makes for the first ten frames of the slideshow presentation available here that made for the Budget overview from Wednesday.

From that overview the evening was turned over to the City's Chief Financial Officer, with Corinne Bomben running through the list of Capital projects and Operational costs required.

Her overview which made for close to fifty minutes of the just over an hour and a half special session, provided an extensive overview of spending towards three elements.

Those included Capital, Special Projects and operation requirements.

The full list of the requests for spending can be found from the slideshow presentation and the full Budget document which was released following the Budget session.

The full list of Budget Requests starts on page 52 of that document.

Of note from those entries, is the volume of spending that has been allocated by way of grant funding which is a testimony to the work of staff to source out those grants and ensure that the city has that process in hand.

Other funding sources for the lengthy list of asks, is by the use of dividends from Legacy Inc. investments and from the Legacy instrument itself.

As you scroll through the list, the ones to watch for which will have the most impact on the increase to the tax rate are listed as the ones that will require taxation for their spending requirements.

Towards how the city will spend money, Ms. Bomben wrapped up her portion of the presentation with some notes the impact of the use of Legacy Inc.

"Legacy Funding is actually saving what could have potentially been a further tax increase of another 13.88 percent and with the water utility funding that is being provided that could have been a 75.59 percent increase in water fees.

But even after all of these dividends are accounted for, the increase as mentioned by Dr. Buchan to balance, is 15.7 tax increase.

The budget shortfall is 3.354 million dollars, the internal rate impacts are sadly not far out of lines with other communities this year, where we differ is the external rate impacts" -- CFO Corinne Bomben at Wednesdays Budget presentation event

Like Doctor Buchan, the CFO also spoke to the issue of the impact of the Port related financial themes and the impact provided this year.

"Just a little bit of perspective, the four capped major industries contribution this year is an additional $75,000 which is 2.1 percent and the average homeowner taxes will go up by approximately $282 over 2022.

So you can see that not being able to share the external and inflationary impact with the capped major industry has consequences on the rest of the taxpayers" -- CFO Corrine Bomben

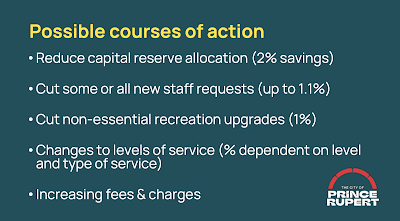

"We've identified some possible courses of action ... taxes affect the operating budget not the utilities budget

So the only way to impact the property tax rate is to propose changes to those services, none of these possibilities are considered reasonable, but if Council would like us to explore the impact we can and bring the possible financial impact back to the next meeting"

There were a few more comments from Dr. Buchan to conclude that part of the presentation.

"We're obviously not pleased about the magnitude of the tax increase, I can tell you that finance staff and all departments worked very hard to remove whatever they could that was taxation based spending.

You'll notice that it is a robust plan for a lot of work, so much of which is supported by grants, by resources and by dividends. Approximately 5.4 million dollars in dividends from Legacy.

That's a huge success story and has enabled us to carry on with so much that is required to be done.

But it's not enough, we don't have enough revenue coming out of Legacy to do everything that we'd like to finance and certainly it can't be used for Operations that would create a hold for the future that we would have difficulty digging ourselves out of.

We did mention the impact of PILT and the Port Tax Cap, that was equivalent to about 14 percent of the budget and we're looking at a 15.7% increase. If we resolve those two matters the budget would be very different" -- City Manager Dr. Rob Buchan

The City Council members for their part reflected a fair bit on the Port related issues for their participation on the evening.

Councillor Cunningham launched the thirty minutes of commentary, the thrust of his themes focused on the reduced PILT rates seeking some guidance on the volume of financial loss from the issues.

"What I would like to know is what the actual PILT rate was and what it was reduced to that makes this big shortfall. And if we got that PILT rate back up to what it was, if the Port in their gracious benevolent mood were to say OK we'll just pay full PILT ... what was that assessed rate first and what did they get it down to by appealing it"

The City Manager noted that it is a change from year to year, towards 2023 the CFO advised him that the impact for this year that of a decline of 70%, or about 750,000 dollars lost out of the budget.

The remaining Council members also had questions related to funding for departments and services, as well as some specific questions related to individual spending on items and leases.

Councillor Niesh noting how this year was the perfect storm, as well as some of the work by Council in years. past, used some of his time to ask residents to break it down towards their own family budgeting and to reflect on what we as residents will get for the taxation we pay.

"I just want people to understand that, realize what you are getting and what you pay.

Figure out what you pay a year and divide in out by 365 days and think about that. And think about are you willing to go out and buy a pack of smokes for twenty dollars or are willing to get all of these services that are in this.

Are you willing to go buy a case of beer for thirty bucks, or are you going to pay ten dollars for all of theses services. And I know it's everywhere, people complain about property taxes and I was one of those people.

But now when I look back at it and I think about what you get for what you pay, it is actually cheap.

Now if you want to have a complaint, start looking at your paycheque every month and figure out what you pay Federal and Provincial governments every day and maybe you'll have a different view where your money goes" -- Councillor Wade Niesh

The Councillor also had a few thoughts when it comes to the Prince Rupert Port Authority t and it's place in the community.

"I'm not happy that we have to look at an increase of this much.

It's sad to think that you know we're in a community that has such massive industrial properties and really they do very little benefit to the community.

As far as building, they do provide a lot of jobs, but as far as maintaining a community for them to be in and for their staff to live in it does very little. So I hope really we can change that" -- Councillor Wade Niesh

Councillor Nick Adey noted that it's not just residential rate payers that will be impacted, but small business owners and those not protected by tax caps and the PILT. To which he called on the public to become involved in the budget process.

"I just want to acknowledge that I think that many of us are hearing this and flittering it through the lens of home taxes, property taxes but we also have businesses in town.

I think that many of them may argue that they are operating on a pretty tight margin and that these kinds of numbers will hurt and I want to acknowledge that, I wish it wasn't so obviously.

And that goes right up the ladder to other larger players who are not protected by the cap and not subject to PILTs so there's a whole lot of players involved here that are going to feel the pinch here in their own ways.

So I guess my encouragement then is for not only homeowners who wish to express their opinions to give us their feedback, but also business owners and anyone else that is in this mix that wants to give us some feedback.

Cause really we need the public's help in understanding what directions to take with this that represent the priorities of the people we serve". -- Councillor Nick Adey

Mayor Pond used his closing comments to review some of the financial challenges and the city's efforts towards resolving the outstanding issues with the province and the Port.

Noting of the provincial funding of 65 million dollars from Friday as a point of pivot, as well as to praise the work of the previous council.

As well Mr. Pond set the stage for what the city's residents will have to focus on as they contemplate the draft budget tax increase of 15.7 %.

"But I think it's actually time, I think it's time, my own view, I can only speak personally to turn to the people of Prince Rupert and say this our town, its our town.

And those roads that have fallen into disrepair are our roads.

And the water system that has fallen into disrepair is our water system.

And if nobody else is going to help us, other than the Premier stepping forward, if we can't get the other sources of revenue, let's turn to ourselves.

Let's start today, to really, really renovate and rebuild our community.

The place that we love, the place where we work and live

And I hope there's good healthy debate over 15.7 and the implications that has for families.

But I've got to tell you, I'm going to be saying let's do what we have to do to rebuild our town.

And let's go to work on attracting all the other forms of revenue we possibly can.

Let's keep working on the RBA, let's keep working on a solution to the Cap that works for everybody.

I'm not pointing my finger at anybody, let's just work on solutions that work for everybody.

And I actually think we're on a pivot point, it goes back to what the Premier did, it goes back to what the previous council did.

I think we've been given a once in a generation opportunity, I honestly believe that, it's a once in a generation opportunity and I think if we seize it, we're going to be amazed what we achieve over the next four years"

The full presentation from Wednesday can be explored from the City's Video Presentation.

The City Manager's opening makes for the first fifteen minutes, Ms. Bomben's listing of the spending requests takes you to the one hour mark.

The final thirty or so minutes was turned over to the Council members.

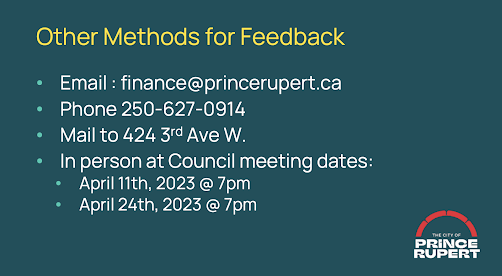

Towards that contemplation on what they think of the budget planning, City residents have two opportunities ahead to deliver their thoughts in person as to where they might guide the Council members towards reducing that tax burden proposal.

They come in person as part of the next two City Council sessions on April 11th and 24th, by mail or phone.

City Staff also pointed out the opportunity to use the city's online Rupert Talks portal to engage in budget themes, including a section where you can shape the budget, as well as to view the impact of the proposed tax rate hike on your property.

You can learn more about those options with links available from the city's website and social media page.

The city could see some significant funding come from those property taxes with property assessments rising this year from BC Assessment.

The full documentation of the Budget is available for review here, a compilation that the Council membership hopes that residents will take a look at and then provide for their commentary over the next month ahead.

We will track all of the 2023 Budget themes through our archive page here.

Has Mayor Pond ever expressed his opinion on the situation with the Port?

ReplyDeleteHe touched on it briefly last night by saying now is not a time to point fingers.

DeleteWhile the high road reduce uncomfortable conflict, he should not be shy in saying that our taxes are going up specifically because of the port authority’s actions.

He should not be shy in saying that it makes no sense for a financially struggling city to susbsidize a federal agency raking in tens of millions in profit.

This is a very good review and raises many issues. One is that it's time to privatize Citywest and free up tens of millions, much like City of Edmonton did in 1995 when it sold its telecom to Telus. The City does not need to be in the telecom business while essential services that residents rely on are at risk of failing on a large scale with serious consequences for public health. (Cue howls of outrage and protests of but, but, but ....)

ReplyDeleteClearly you missed the main distinction between a capital vs an operating budget.

DeleteSelling Citywest would not mitigate the operational budget deficits being caused by declining Port revenues. Quite the opposite.

Selling Citywest would be a one time infusion of cash (like the province’s $65 million grant announcement last week) that would not stop future tax increases.

the annual Citywest “dividend” is actually helping keep taxes lower. So if the City sold it, that’s another $600k in tax increases that would be necessary.

So please take your financial expertise to the banana stand.

Since 2005, Citywest has remitted $9.6 million in debt repayment. ( aka dividends / novelty cheques)

DeleteDuring that time,

- Citywest has missed dividend payments to the city of Prince Rupert

- The city of Prince Rupert forgave $20 million in debt.

- Citywest is currently $20+ million in debt with the city of Prince Rupert

- Years into the local Fibre to Home project in Prince Rupert and they have only completed 60% of the project. Work started in 2018.

- Citywest charged City Hall $156,795 in 2021 for their services. https://www.princerupert.ca/sites/default/files/reports/SOFI%20June%2013%202022.pdf

The "distribution payments" are - according to the City's audited financial statements - actually "loan repayments" on the a $22,400,000 loan to Citywest. Since the principal is unchanged from 2019, the $800,000 payment is essentially a 3% interest payment on the loan. Citywest does not actually pay dividends, i.e. profits, to the City. It repays debt under very generous terms.

If the city sold CityWest for 30 million and realized 3% on that 30 million it would amount to $900,000.00 a year.

DeleteI'm not interested in banana stands, or in trading insults. Revenue from selling City-owned land and improvements must be put into a City reserve fund and can only be spent on capital purposes. Revenue from selling shares in a municipal corporation, in contrast, is general revenue and can be retained or applied as contributions to the capital budget or the operating budget.

DeleteIf the City sold all public land it could do the same thing. If the city sold all recreation assets ot could do the same. If it privitized water and sewer it could do the same thing.

DeletePublic ownership of essential utilities is a heck of a lot better than the alternative.

I thought Watson Island was going to save us from tax increases.

ReplyDeleteOnly 13% of Watson is currently leased.

DeleteAny Watson revenues flow through Legacy.

Are we in a better position with Watson than in 2009 when the city took it over, yes.

It would be a useful exercise to show the positive impact if Watson was 25%, %50, %75, and %100 leased.

Taxes were lower, roads were better, fewer employees and third avenue was standing in 2009

DeleteIf Watson Island was not back on the tax roll, it would have been an additional 14% tax increase and 76% utilities increase just this year alone.

DeleteIt is definitely saving us. See page 98 of budget presentation on City’s budget presentation slides.

Why is it I don’t feel saved.

DeleteLots was better in 2009: the Great Recession. Pipeline bombings. And our 110 year old pipes were only a spry 97 years young.

DeleteBut wait, Gordon Campbell was Premier and Stephen Harper were in charge, so all must’ve been good!

No Rushbrook trail, no Cow Bay marina, no CN Station, no cruise ships, no pellet terminal, no Altagas, no Pembina, Watson Island still costing us $90k per month, legal fights with SunnWave….

Yeah, things were much better in 2009.

What ever happened to do more with less. There has not been any cuts to speak of in years. Nine years ago the administration was taking salary bonuses for four years.

ReplyDeleteThe CN Station, growing the number of city employees and McCarty Motors, (there has to be another option) all cost the city. What did the B.C. Packers warehouse cost the city. I don’t want to mention Watson Island.

Fire dept. manning in less the ten years has more than doubled.

We ran the airport ferry for 6 months with no scheduled flights.

The financial problems didn’t occur overnight the city management has chosen to magnify the problems by spending rather then looking for cuts.

It is time to rethink the plan. Council has to start pushing back.